Foreclosures: Four Fast Facts

You may be hearing the word “foreclosure” a lot these days. According to Black Knight, January 2022 saw an alarming 700-percent year-over-year increase in foreclosure starts, and so far this year, rates are continuing to rise month over month. These results, compounded by rising inflation and energy costs and the global pandemic, may trigger painful memories of the last time our economy faltered, taking the entire housing market down with it: The 2007-2009 Great Recession.

However, things aren’t as bad as they may seem.

It’s important to remember that an underlying cause of the Great Recession was a combination of rising home prices and an expansion in access to housing credit that led to an increase in subprime mortgages. According to the Joint Center for Housing Studies, there were over 3.7 million completed foreclosures as a direct result of the Great Recession. In response to this crisis, the U.S. Congress enacted tougher banking laws, including The Dodd-Frank Act of 2010, which created new provisions for the treatment of large financial institutions.

In contrast, it is believed that together with other post-Great Recession regulatory reforms, the Coronavirus Aid, Relief, and Economic Security Act (also known as the CARES Act), has prevented the same mortgage foreclosure surge from happening during the COVID-19 pandemic. Enacted on March 27, 2020, the CARES Act provided two different homeowner protections: A forbearance period for mortgage payments, and a moratorium on foreclosures. The forbearance period allowed borrowers to temporarily pay their mortgage at a lower payment, or pause making payments for a period of time without risk of being in default. The moratorium on foreclosures prevented federally backed mortgage servicers from initiating foreclosure on residential properties when borrowers were experiencing financial hardship due to the pandemic.

Although these protections expired in 2021, the CARES ACT enabled millions of homeowners to stay in their homes during the COVID-19 pandemic, and possibly prevented – or at least delayed – a second mortgage foreclosure crisis until the effects of the pandemic on the economy could better be understood.

While it is true that 2022 has seen an increase in foreclosure activity from the prior two years, these other factors may continue to prevent the sort of foreclosure crisis we weathered a decade ago:

- Demand for homes is outpacing available inventory;

- Continued increases in home values; and

- Homeowners may have more equity, enabling them to more easily sell their home or refinance their existing mortgage.

As we continue to monitor rising foreclosure rates, here are four basic points to remember:

A homeowner facing mortgage default or foreclosure can expect their foreclosure to proceed either judicially or non-judicially, depending on the state where the property is located and on the foreclosing lender’s preference.

1. In some states, foreclosures are handled judicially.

This means the foreclosure process takes place through the court system. The procedure is carried out according to the laws of the jurisdiction in which the property is situated, which is almost always state law. However, this option is available in all states.

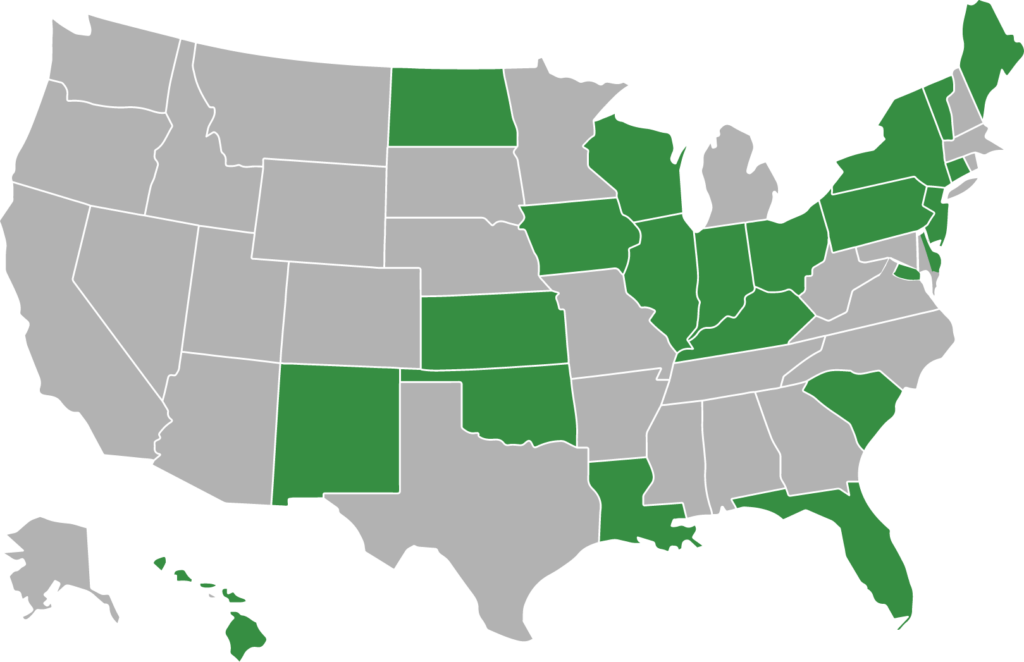

States that primarily use judicial foreclosures are:

Judicial Foreclosure States

Connecticut, Delaware, District of Columbia, Florida, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, New Jersey, New Mexico, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont and Wisconsin.

The judicial foreclosure process begins when a borrower is delinquent on payments for 120 days. A mortgage servicer then sends the foreclosing party a breach letter, informing the homeowner that they are in default and have 30 days to cure it. If they are unable to do so, the foreclosing party files a lawsuit in the county where the property is located, and requests that the court allow the home to be sold to pay the debt.

If a court finds that a homeowner has defaulted on their mortgage, an auction can be scheduled to sell the property in an attempt to acquire the funds needed to repay the mortgage lender. In some cases where the auction fails to generate enough funds to repay the lender, the homeowner will be held liable for the remaining balance.

A judicial foreclosure is often a lengthy process, taking several months or even years to complete.

2. In some states, foreclosures are handled non-judicially.

Non-judicial foreclosures follow state-specific procedures, with a trustee overseeing the process instead of a judge. While the non-judicial foreclosure process varies from state to state, generally, a servicer initiates the process when the homeowner is more than 120 days delinquent in payments. During this process, the homeowner may receive information about loss-mitigation options to stave off foreclosure.

State laws prescribe how much notice a homeowner gets, how the property will be sold (commonly at a public auction) and what rights (if any) a homeowner has to reinstate their loan before the foreclosure sale, or to redeem their home after it is sold.

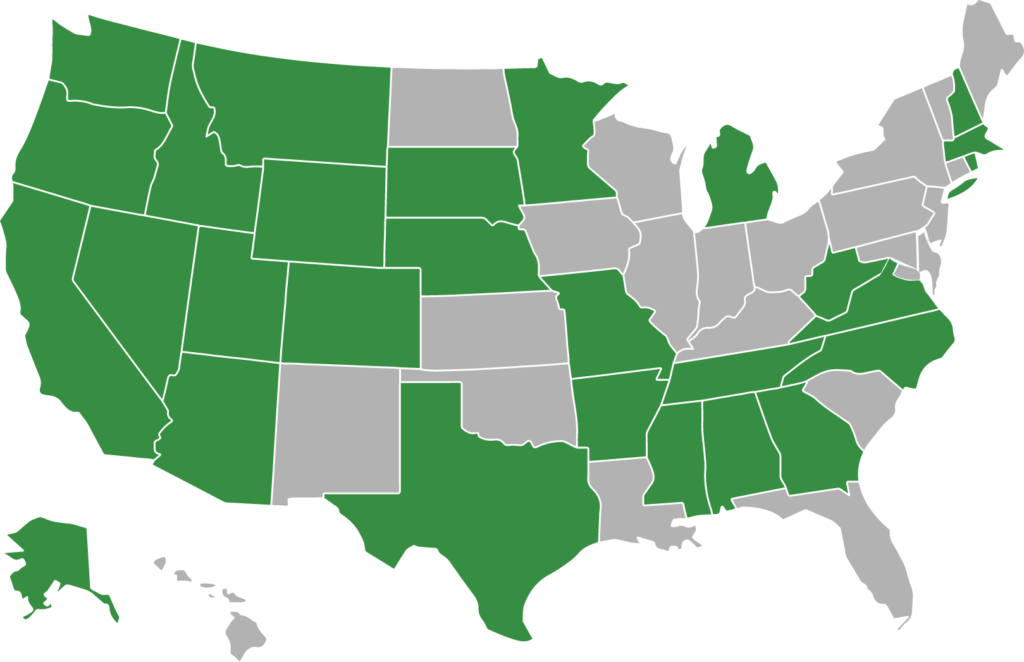

States that primarily use non-judicial foreclosures are:

Non-Judicial Foreclosure States

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Georgia, Idaho, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, North Carolina, Oregon, Rhode Island, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, West Virginia and Wyoming.

Non-judicial foreclosures are usually a much shorter process than judicial foreclosures, as they follow a specific timeframe set by state statutes. If a homeowner is unsatisfied with the outcome of this process, they may file a lawsuit to resolve their concerns in court.

While we hope that another large-scale mortgage foreclosure crisis can be avoided, there are two different foreclosure-related title insurance products available for use by title professionals.

3. A Trustee Sale Guarantee (TSG) is a title guarantee available for use in non-judicial foreclosures.

Issued at the start of foreclosure, a TSG provides the foreclosing beneficiary and trustee with the assurance that the trustee has the names and addresses of the parties entitled to receive statutory foreclosure notices in compliance with state foreclosure statutes.

The coverage afforded under a TSG is limited to actual loss or damage an assured (not insured) suffers as a result of any incorrectness in the names and addresses provided in the TSG for the foreclosure notices. For Doma-insured transactions, pricing for the TSG is available in the applicable state’s Doma Title rate manual.

4. A Litigation Guarantee is a title guarantee available for use in judicial foreclosure actions.

A Litigation Guarantee is similar to the TSG, but is available for use in states where a judicial foreclosure will take place. A Litigation Guarantee offers the attorneys representing the plaintiffs the protection that they have named all proper parties as defendants in their case.

A final decree in an action affecting land is only binding on the parties named as defendants. Therefore, in a mortgage foreclosure action, it is important for the foreclosing lender to include all parties with an interest in the land. The Litigation Guarantee assures the names and identities of current interest-holders that the attorney will most likely wish to name as defendants in the action. For Doma-insured transactions, pricing for the Litigation Guarantee is available in the applicable state’s Doma Title rate manual.