Wrapping Your Head Around Wrap-Around Mortgages

By Kelsea Laun, Esq.

If you are relatively new to the housing market, you may not be familiar with the term “wrap-around mortgages.” A popular tool in the early 1980s, they seem to be making a comeback thanks to rising interest rates, waning inventory and high demand. These factors often revive the use of unconventional mortgage and seller-financing loans, including wrap-around mortgages.

Here are answers to your wrap-around mortgage questions.

1. What is a wrap-around mortgage?

The term “wrap-around” refers to a type of mortgage financing where the buyer pays a mortgage to a third-party lender, or the seller, including the unpaid principal of an existing mortgage that is not paid off at the time of closing. Hence, the new mortgage “wraps around” the seller’s existing first-priority mortgage and secures an additional amount for the unpaid principal amount of the sales price not paid at the time of closing.

2. How does a wrap-around mortgage work?

A buyer and a seller contract for the buyer to pay for the purchase of the property by giving the seller, or third-party lender, a mortgage in the amount of the sales price (less any downpayment paid by the buyer).

Provided there are no other mortgages in place at the time of closing – other than the existing first-priority mortgage that is being wrapped around – the buyer takes title with two mortgages recorded against the property:

- The seller’s existing first-priority mortgage; and

- The buyer’s new mortgage in favor of the seller or third-party lender.

The buyer makes their monthly mortgage payments to the seller or third-party lender, who in turn pays the lender on the first-priority mortgage. Because the wrap-around mortgage includes all amounts due on the existing first mortgage – which the seller or third-party lender agrees to pay – the buyer typically does not assume the first-priority mortgage but takes title subject to it. The promissory note given by the buyer to the wrap-around mortgagee is for the full principal amount owed, including the unpaid principal balance of the mortgage wrapped around by the buyer’s newly executed mortgage.

It is important to note that the financial terms of the wrap-around mortgage may differ materially from those of the mortgage it wraps around. To illustrate, it is possible that the wrap-around mortgage may be interest-only with a balloon final payment, even though the first mortgage it wraps around is a traditional amortizing mortgage. What is critical, however, is that the wrap-around mortgage and note, which it secures, specify that they include all amounts due on the underlying mortgage wrapped around, and that the original borrower – now the seller – covenants and agrees to fully pay and discharge the mortgage wrapped around out of the payments it will have received from the purchaser under the wrap-around mortgage.

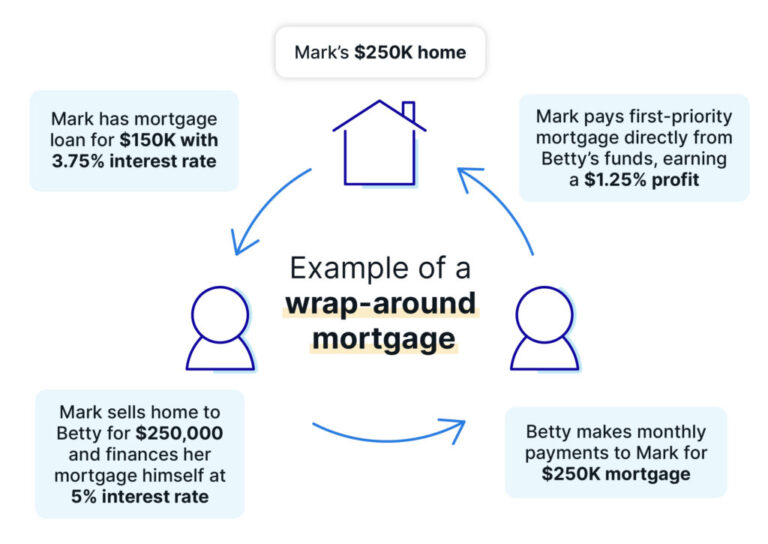

Here’s an example:

- Mark owns his home that is encumbered by one mortgage in the amount of $150,000 with an interest rate of 3.75%. The home is currently valued at approximately $250,000.

- Betty, the buyer, contracts to purchase the home from Mark for $250,000. Betty is unable to qualify for a conventional mortgage loan, so Mark agrees to finance Betty’s mortgage himself.

- Betty executes a mortgage loan in favor of Mark in the amount of $250,000 at an interest rate of 5%.

- The new loan encompasses, or “wraps-around,” Mark’s existing mortgage.

- Betty makes monthly payments to Mark on her $250,000 mortgage, and Mark pays the first-priority mortgage directly from funds received from Betty.

- Mark ends up earning a profit from the 1.25% spread between the 3.75% interest rate owed to the original lender for the existing first-priority mortgage, and he gets the full 5% on the $100,000 he loans to Betty.

3. What are the benefits and risks involved in a wrap-around mortgage?

Wrap-around mortgages carry both benefits and risks for all parties to the transaction. Consider the following:

For the buyer:

Benefits: Typically, a buyer who enters into a wrap-around mortgage with a seller has pursued – but has not been able to secure – traditional financing. The main benefit of a wrap-around mortgage for a buyer is that it allows them to purchase a property with financing that may otherwise not be available.

Risks: With traditional financing, the buyer would be depending only on its own ability to repay the mortgage. However, with wrap-around financing, the buyer is subject to the risk that the seller will fail to pay its first-priority mortgage, leading to foreclosure of the property. Further, the interest rate charged on a wrap-around mortgage is usually higher than the going rate for conventional mortgage financing.

For the seller:

Benefits: The biggest benefit to the seller who provides financing for the sale of their property via a wrap-around mortgage loan is that the transaction can typically be closed as quickly as a cash transaction. In addition, the seller earns additional interest income on the spread, or the difference between the interest rate on the wrapped-around mortgage and the interest rate on the wrap-around mortgage.

Risks: Most institutional mortgages contain due-on-sale clauses which may allow the first-priority lender to foreclose based on the sale, regardless of whether payments under the note remain current. This scenario poses a risk to the buyer as well. One way to mitigate this risk is to require the wrap-around mortgagee to affirmatively covenant to fully satisfy and discharge the mortgage wrapped around, in the event that lender accelerates that loan for any reason.

It is also important to remember that the seller is likely relying on the buyer’s mortgage payment to fund the monthly payments due to the first-priority mortgage. If the buyer defaults, the seller could foreclose, but only in second priority, and their credit could be affected due to the buyer’s non-payment.

For the title agent:

Risks: FHA loans insured after December 15, 1989, cannot be assumed without the buyer credit qualifying for the loan. If the existing first-priority mortgage is an FHA or VA loan, and the buyer cannot qualify for assumption of such a loan, title companies and brokers involved in the transaction may be subject to sanctions by the U.S. Department of Housing and Urban Development. Because of the elevated risks associated with wrap-around mortgages and their idiosyncratic requirements, title agents are well advised to require that the wrap-around mortgage and wrap-around promissory note it secures be drafted by outside counsel. This also avoids concerns about the unauthorized practice of law by the agent.

Underwriting considerations and final thoughts

Underwriting requirements for transactions involving wrap-around mortgages vary by state. In addition, title insurance commitments involving a wrap-around mortgage should specifically call for the execution, delivery and recording of a wrap-around mortgage and promissory note from the buyer in favor of the proposed insured lender.

Unless there is a state-specific regulation to the contrary, the title policy insuring the lender on a wrap-around mortgage should be issued for the full value of the loan, including the outstanding amount of the existing first-priority mortgage. In the example of Betty’s deal, the loan policy will be issued with an insured amount of $250,000. The premium should be calculated on that amount based on the applicable premium rates published in the rate manual for the state in which the property is located. Endorsements may also be issued to the loan policy in the same manner as for loan policies insuring conventional loans.

In addition, several legal questions arise relating to applicable state law on usury, intervening liens, acceleration, state-specific requirements and other state and federal regulations. These mortgage tools can be a valuable opportunity for first-time homebuyers or those with financial setbacks impacting their credit worthiness. It is always a good idea for title agents to stay abreast of these non-traditional mortgage arrangements.

We invite our valued agents and approved attorneys to contact their local Doma underwriting counsel with any questions or concerns regarding transactions involving wrap-around security instruments.

Kelsea Laun is Vice President, Southeast Regional Underwriting Counsel for Doma Title Insurance, Inc.